PRESS RELEASE: DEMAND FOR CREDIT HIGH AND BANK CHARGES HURTING

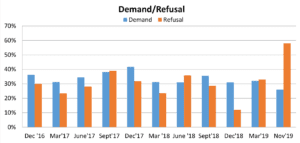

- SME demand for credit is at 31%.

- Loan refusal rates increase from 33% to 58%.

- 14% waiting longer than 10 weeks from permission to drawdown.

- 75% stated that banks are making it more difficult to access finance.

- Businesses wait on average two weeks from decision to drawdown.

- 5% of SMEs pay between €5000-10000 in Bank Charges (excluding interest).

ISME, the Irish SME Association, yesterday (25th November) released its quarterly Bank Watch survey for Q3’19. The results show an increase in loan refusal rates, increasing from 33% to 58%. Demand for credit remains high at 31%. Waiting time from decision to drawdown is on average two weeks. The Association highlights the need for more credit to be made available to SMEs and the length of time it’s taking for SMEs to access finance. It calls for banks to promote the availability of SBCI funds in a more coordinated manner.

Commenting on the results, ISME CEO, Neil McDonnell said:

“Demand for credit has declined, while refusal rates for formal applications have increased. This is consistent with our recent findings of poorer business sentiment among SMEs, which we hope will not persist into the New Year.”

The main findings from the 285 respondents in the last week of September are as follows:

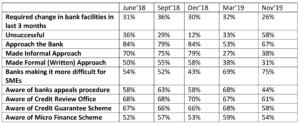

- 25% of respondents required additional or new bank facilities in the first three months of 2019, down 4% on Q1’19.

- 58% of companies who applied for funding were refused credit by their banks, an increase of 25% from Q1’19.

- Awareness of the Credit Review Office was at 61%. There was a nominal decrease in awareness of the Credit Guarantee Scheme from 68% to 58%, while awareness about the microfinance scheme fell from 59% to 54% in Q3’19.

- 32% of applications were awaiting a decision late-November.

- On average, businesses are waiting three weeks for an initial decision on loan applications. The wait time for drawdown was two weeks.

- 23% of initial bank decisions were made within the first week; a decrease of 9% on previous quarter. 23% are waiting four to six weeks, while 8% are waiting more than 10 weeks.

- 31% of those who required funding made a formal application, a decrease from 57% in the previous three months, while informal applications decreased from 79% to 38%.

- 31% of those who required funding made a formal application, while informal applications made up 38%. 31% of applications made were done by other forms/ means.

- Of the 37% approved for funding, 100% have drawn down finances either fully or in part.

- 45% of respondents had cause to be concerned about bank fees and charges.

- 72% state that the Government is having either a negative or no impact on SME lending compared to 70% in the previous Quarter.

- 4% of businesses report that their debt has been sold by their lender to another institution.

- 56% have been with their bank for 20+ years.

- 11% of SMEs spend less than €100 on Bank Charges (excluding interest), 18% between €100-€250, 46% between €250 and €2500, 13% between €2500-€5000, 5% between €5000-10,000 and

- 4% spend between €10,000-€20,000. The remainder pay no charges.

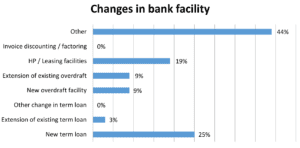

25% of respondents requested a ‘New Term Loan’, compared to 26% in Q1 of 2019. 3% requested an ‘Extension of an Existing Term Loan’, 0% requested ‘other changes’ to their term loan’, and 9% requested a ‘new overdraft facility’. 9% applied for an ‘Extension of Overdraft Facility. A further 19% requested HP/Leasing facilities, while 0% applied for Invoice Discounting/Factoring.

END

- ISME should be referred to as the Irish SME Association

- This survey was conducted in the last week of September, covering the third quarter of 2019.

For further information, please contact Sheema Lughmani, T: 01 6622755, E: [email protected]